Section 179 Deduction Vehicle List 2024 Free

- admin

- 0

- on

Section 179 Deduction Vehicle List 2024 Free – Long ago, in 1958 Congress passed one of its many laws making “technical corrections” to the Internal Revenue Code. Mostly, these are truly technical corrections but there are times when . Most years, the IRS increases the standard deduction to account for inflation. In 2024, the standard Read more: we researched free tax software and put together a list of the best options .

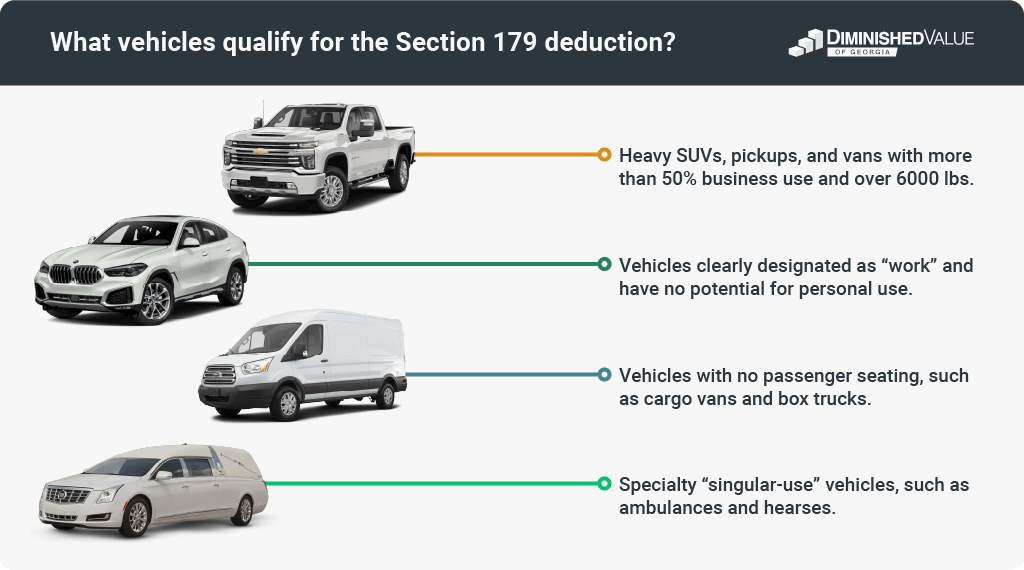

Section 179 Deduction Vehicle List 2024 Free

Source : diminishedvalueofgeorgia.comSection 179 Deduction Vehicle List 2023 Mercedes Benz of

Source : www.mercedesoflittleton.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comVehicle Tax Deduction: 8 Cars You Can Get Basically for Free

Source : lyfeaccounting.comVehicle Tax Deduction: 8 Cars You Can Get TAX FREE Section 179

Source : www.youtube.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comList of Vehicles Over 6000 lb that Qualify for the 2023 IRS

Source : www.taxfyle.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comSection 179: Definition, How It Works, and Example

Source : www.investopedia.comTax Penalties, Section 179 and Bonus Depreciation Changes for the

Source : www.dtnpf.comSection 179 Deduction Vehicle List 2024 Free List of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in : Property that qualifies for this tax break includes machinery, tools, furniture, fixtures, computers, software and vehicles. (This special rule often goes by the alias “the Section 179 deduction . You have to understand the time period that regular depreciation allows as well as options for bonus depreciation or Section 179 deduction You purchase a vehicle for $30,000. .

]]>

:max_bytes(150000):strip_icc()/Term-Definitions_Section-179-resized-1a04b9f84c4d4141b11d1d9ca10fb981.jpg)